August 10th, 2017

Choosing the right KPIs will help you have a 360-degree image of your employer branding strategy and improve it from one period to another. You will find some inspiration in the article below, but your employer branding priorities should dictate which of them are important to you.

Choose a war you can win:

! 1st, before setting any KPI, make sure you choose wisely the target group for your employer branding efforts, otherwise you will fight a war you cannot win and waste your resources. While it is important to choose a broad enough audience to cover all your recruitment needs now and in the future, in most of the cases, employers set an unrealistic target. This will hinder your efforts to measure success as the budget will not follow the high ambitions.

Let’s take a hypothetical example. One company with offices in Bucharest and Cluj-Napoca decides they want to be the most desired employer nationwide. Unless they plan to relocate a high number of candidates or to have a massive geographical expansion, this will dilute their effort. The same way a magnifying glass can set a paper on fire by focusing solar light, your focused employer branding efforts will yield faster and better results. We will dig deeper into this subject in a future post, but for now let’s return to KPIs.

Awareness

After we’ve set the target, we can set objectives starting from the Employer Branding funnel. You want your target to be aware of your existence as an employer. Some might already know your corporate brand and it can help (or not :). You want them to know more about the careers they can pursue with you and to know the things that make you stand out as employer (your EVP and the employer branding pillars). The KPIs can measure the % of your target group who are aware of you as an employer. Secondary KPIs can measure the % that associate certain attributes to your employer brand. E.g. 70% think of us when talking about a great working environment.

You can complicate or simplify this as much as you want. You might want to have different KPIs for different target groups which are important to you or for geographical locations.

Awareness will be measured in our survey starting with this year. Besides awareness, “Most Desired Employers Study” measures which companies are most popular for each of the important criteria candidates use when choosing their employer (compensation & benefits, working environment, development opportunities).

Consideration

They know about you. The question is if what they know makes them want to work for you. We all know employers for which we would never work, so it is not only about awareness.

The KPI might be a ratio among those who know you and would consider you for a career now or in the future. To use a familiar term for recruiters – at this stage you want to be on the long list. Some candidates might have a list with 100 considered employers and others with just 30. As we grow more experienced our list tends to narrow. This is the KPIs most of the EB surveys measure (including ours, of course).

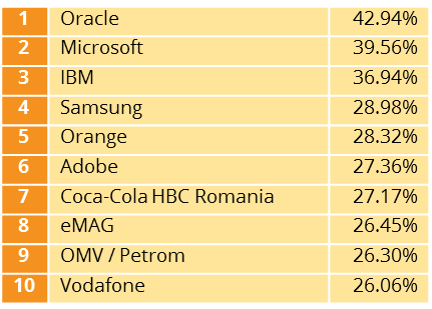

Here are the top 10 companies respondents in the Bucharest would take into consideration for a job, along with the percentage of people who listed them:

Desire

Out of this list, there are some employers who really stand out, the ones we dream to work at. They are our ideal employers and come first in our minds when we think about changing our job. For them, we might relocate, we will refuse bigger offers and we will go through a more complex and a tougher selection process. They are the ones who generate the cocktail effect – when mentioning we work for them at a cocktail, people will raise an eyebrow in admiration. They have the coolness factor.

The KPI you measure can be the % of candidates who shortlisted you in a select club of loved employers.

If you analyze the % of those who are in this stage but did not tick the box at the previous point you will find some interesting conclusions. This is the place where you might have some quick gains. The reasons are plenty and might show you where you can improve. Among them: the employer is not hiring in my city, in my field or my level of experience. Another reason might be that candidates think you don’t hire because they did not see your jobs or because they believe that they will never pass your tough selection process. Improving these areas might be KPIs on their own. We all know companies which are so exclusivist with the channels they use to promote their jobs that good candidates who would love to work for them have a hard time finding the jobs.

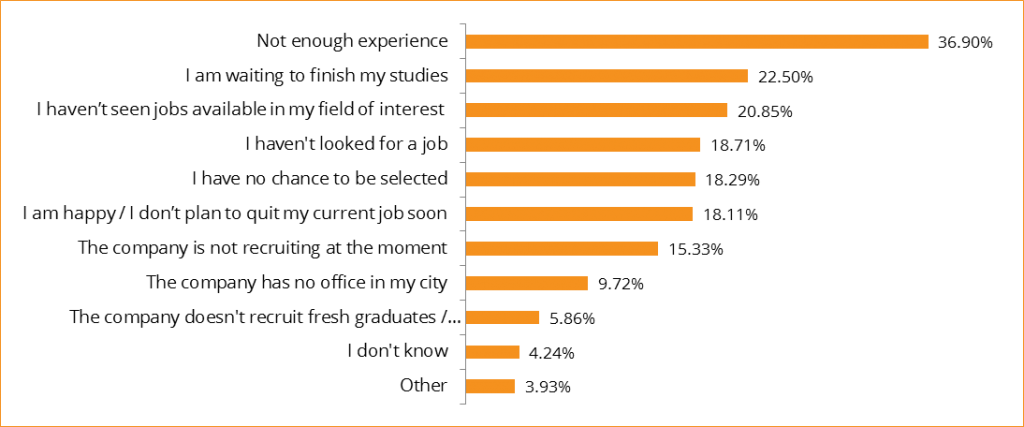

In our survey, you can find information regarding your ranking among the most desired employers, but also an analysis of the reasons for which respondents din not apply for a job within your organization. For example, here are the reasons for which respondents do not pursue a job within their most desired employer:

*Percentages out of total valid 11.036 respondents

*Percentages out of total valid 11.036 respondents

Source: Extract from the Most Desired Employers Study 2017

Application

This takes us to the last part of the funnel. The truth is that candidates can skip all the previous steps and start applying. Among them, some have no criteria and apply in mass, but some are the ones we want. The more experience a candidate has, the bigger the chances are that he will go through all steps of the funnel (awareness – consideration – desire – application). This is also valid for really bright juniors – HiPos as we like to call them. They are the ones who do not leave their career decisions to chance. Good KPIs would be: the total no of applicants, the total no of people who viewed your jobs and a ratio between views and applied. It would be useful to compare your targets against industry & domain benchmarks (ask us if you need them). Other KPIs might be the % of fit candidates out of all applicants and % of hires out of all applicants.

Although Application is the part of the funnel we know best as we have been doing it before the term employer branding was coined, we often fail now at doing a decent job. Maybe because we have divided our efforts between all the new channels, with social media eating so much of our time or maybe we just love the previous steps more. The hard fact is that we have to improve the way we approach this last phase as it has a major role to play in the final result.

There is a new term on our radar – candidate journey – and hopefully it will draw some attention to this step. A recent presentation held by Mervyn Dinnen posed an interesting question: “Does your Recruitment Experience Resemble the Labors of Hercules?”

Some points you might consider:

- How visible are my jobs for potential candidates?

- How do my jobs stand out in a market with hundreds and in some cases thousands of similar jobs?

- Do my JDs contain all relevant information for a candidate to make a decision on the spot or does he need to do a bit of research to figure this out?

- Is the application process friendly? – the benchmark today is one click apply; A KPI to measure this is the No. of seconds it takes you to find and apply for a job on desktop and mobile;

- Is my application process designed to keep candidates away from the time when we used to get hundreds of applicants or streamlined for mobile experience?

Be aware that in the last years these indicators were dropping across the board as the labor market got saturated in some cities and some industries. In some domains (IT, Customer Service, Engineering, Accounting) maintaining the previous year situation would be a major achievement and would require extra budgets and effort. Failing to adjust your KPIs to changing market conditions might result in 0 KPIs met at the end of the year.

The list can be longer. Engagement among current employees might be a shared KPI, colleagues acting as ambassadors and the results generated by the referral program can also be on your KPI list. As we found out in a research among hipo.ro users, as many as 40% of the candidates can find out about a job on Hipo but choose to apply through friends at that company or directly contact the hiring manager. We call it passive referrals as your colleagues are just forwarding the CV and take the bonus  What is the % of passive referrals in your company and who would have thought that job postings can boost the referrals? The truth is that people need to find out from somewhere about your jobs if the employees are not actively promoting them.

What is the % of passive referrals in your company and who would have thought that job postings can boost the referrals? The truth is that people need to find out from somewhere about your jobs if the employees are not actively promoting them.

How often you measure, depends on you. Standard practice is yearly, for some KPIs such as brand awareness or level of desire and weekly, for applicants to visitor’s ratio. On the other hand, if you have an extensive campaign you might want to measure some of the KPIs at the end of the campaign.

What else would you include on the list? Please share with us.